May 5, 2022

New Zealand velvet industry continues to grow

New Zealand velvet industry continues to grow

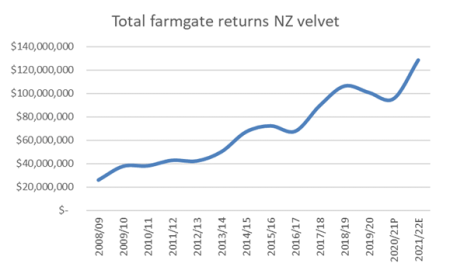

- An early estimate for the 2021/22 velvet season is that farmgate returns will pass NZ$120m, up from just under $100m the previous season.

- This increase comes from a combination of improving prices and increased production.

- Farm gate price fluctuations continue to be driven by changing market conditions and currency, however the sector has not recently experienced the extreme volatility that characterizsed its early years.

NZ velvet buyers and exporters successfully navigated a highly challenging season.

During the peak of the season, NZ buyers and exporters had to implement processes to minimise the risk of Covid-19 getting into their packhouses and risk being delisted from China. The pressure was exacerbated when the only Chinese port accepting NZ velvet (Dalian) was closed due to localised Covid outbreaks. This closure resulted in booked containers being cancelled and many exporters scrambling to secure China approved freezer space to hold consignments until it was reopened several weeks later.

Velvet’s status as a TCM ingredient means that Dalian was the only port to export to (since then, another port has reportedly accepted and cleared consignments of NZ velvet).

While it now feels a lifetime ago in NZ, lockdowns are still a key tool the Chinese government uses to achieve its current zero Covid policy. Logistic challenges such as port closures are a result , but there will also be economic ramifications. The shutdown of many major cities (including Shanghai) has resulted in temporary closure of many companies, which is impacting business confidence. Hopefully China will be well through this when out next season begins.

In contrast, and similar to NZ, South Korea is starting to open up after experiencing in excess of 600,000 cases a day at the peak. Some normality is returning to the busy streets of Seoul.

Highlighting recent immune function research

Highlighting recent immune function research

AgResearch recently completed a study on velvet’s effect on human immunity. A brochure has been prepared that highlights a positive impact. However, this is a small study, with significant investment and further research required before any type of claim might be made. These brochures are now filtering out into the market (for a copy email: rhys.griffiths@deernz.org). Our Korean customers welcome the development and are looking forward to future research. The brochure has also been printed in Korean.